Following the dispatch of the main Bitcoin Futures Exchange Traded Fund (ETF) in the US on October 19, and the energy that it imbued in the crypto market, the worth of Bitcoin rose to an unequaled high of $66,000.

Upon the arrival of its dispatch, the Bitcoin ETF began trading at the New York Stock Exchange (NYSE) and roughly 29 million Bitcoin fates ETF shares, called BITO, were sold on this very day on ProShares.

Digital currency

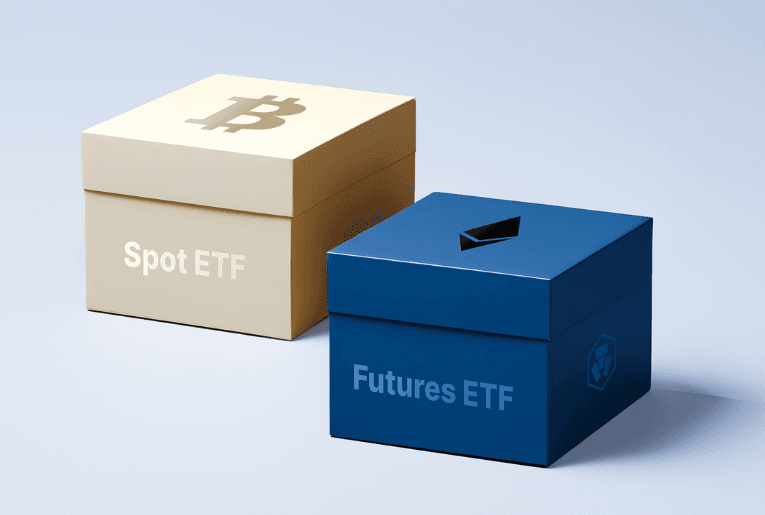

So what is Bitcoin prospects ETF and Bitcoin ETF? How can it help in the standard acknowledgment of digital currencies? We uncover the subtleties of two sorts of crypto-based ETFs.

What is a Bitcoin Futures ETF?

ETF is a kind of safety that tracks a file, ware, or some other resource, however, it very well may be bought or sold on a stock exchange in a similar way as any standard stock. ETFs are directed monetary items that address a wide scope of resources.

Bitcoin prospects ETF is a sort of controlled monetary item implied for those investors that are not talented in cryptocurrency trading yet purchase stocks through money market funds.

It permits them to acquire investment openness and in a roundabout way take part in the Bitcoin market. In any case, in contrast to common funds, ETF offers can be purchased and sold whenever during market trading hours.

Note that each portion of a bitcoin prospects ETF is upheld by Bitcoin fates contracts.

Also Read:

What are Bitcoin fates agreements and how would they function?

Bitcoin fates are a sort of subsidiary trading instrument. Bitcoin fates contracts commit two gatherings to commonly consent to purchase or sell Bitcoins at a foreordained worth on a specific date in the future, known as the agreed settlement date.

For the unenlightened, the subsidiary alludes to any trading contract that tracks the cost of a hidden resource. Bitcoin prospects are generally traded on the exchange of an item.

* The arrangement ties both the gatherings to purchase or sell Bitcoin at the foreordained cost on the settlement date independent of the current worth of the coin.

* If the purchasing party buys Bitcoin after the fates contract terminates, then, at that point, they would need to get it at either a premium or a limited rate.

* The purchasing cost of the Bitcoin as of now will rely upon the market cost or spot cost and the worth of every one of the fates contracts they currently possess.

What are Bitcoin ETFs?

The Bitcoin ETF is upheld by genuine Bitcoin :

* The cost of Bitcoin relies upon the value development of the genuine Bitcoin.

* The organization needs to reliably guarantee that it has enough Bitcoin stores to back the worth of its Bitcoin ETF.

* Canada as of now has numerous crypto-put together ETFs trading with respect to the Toronto Stock Exchange.

Presently, what’s the contrast between the Bitcoin Futures ETF and Bitcoin ETF?

* Bitcoin ETFs are upheld by actual Bitcoin, while the Bitcoin fates ETFs are supported by subordinates of Bitcoin or fates contracts.

* Bitcoin fates ETF may now and again follow the cost of the Bitcoin incorrectly attributable to flighty market opinions. Then again, there’s no danger of value difference on account of Bitcoin ETF as it is upheld by genuine bitcoins.

Source: https://gadgets.ndtv.com/finance/crypto-currency-price-in-india-inr-compare-bitcoin-ether-dogecoin-ripple-litecoin